Understanding Credit Card Processing Fees

Credit card processing fees can significantly impact your pharmacy's bottom line. At Waypoint Rx, we specialize in helping independent pharmacy owners reduce these fees to improve profitability and financial efficiency.

Comprehensive Fee Analysis

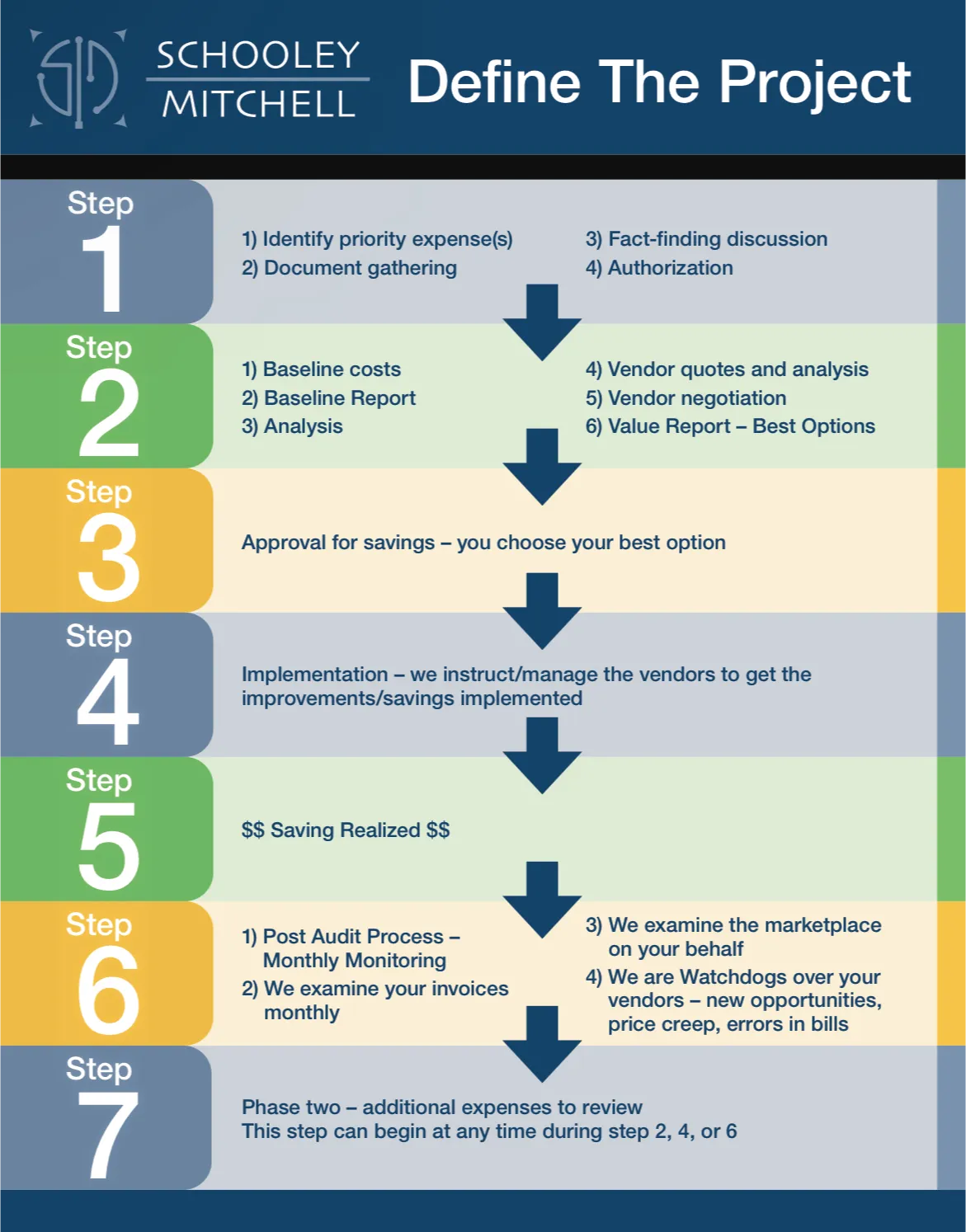

Our service begins with a thorough analysis of your current credit card processing fees. We review your merchant statements and identify areas where savings can be achieved. This includes examining interchange fees, assessment fees, and other charges associated with processing credit card transactions.

Customized Cost-Saving Solutions

Based on our analysis, we develop customized solutions tailored to your pharmacy's specific needs. This may involve negotiating lower rates with your current payment processor, exploring alternative processors offering competitive pricing, or implementing strategies to qualify for lower interchange rates.

Implementation and Support

Once cost-saving solutions are identified, we assist with the implementation process to ensure a smooth transition. Our team provides ongoing support to monitor your new fee structure and address any issues that may arise.

We are committed to helping you maintain low processing costs while maximizing the convenience and security of credit card transactions for your customers.

Why Choose Waypoint Rx?

Choosing Waypoint Rx for credit card processing fee reduction means partnering with experts who understand the unique challenges faced by independent pharmacy owners.

We have a proven track record of successfully lowering processing fees for our clients, allowing them to allocate more resources to improving patient care and expanding their business. With our help, you can achieve greater financial efficiency and competitiveness in the marketplace.